Case Study: GMX x Arbitrum x Chainlink

Interview with Fred, BD Contributor, and Jonezee, Communications Contributor at GMX.

Name and role at GMX

Fredegar Christensen, Business Development Contributor

Jonezee, Communications Contributor

What sets GMX apart as a platform?

GMX was among the first fully on-chain perpetual exchanges to find a clear Product-Market Fit. This likely had to do with some of the protocol’s defining characteristics:

Usability - Traders can instantly trade straight from their wallet, with no account, custody or registration needed

Intuitive UI - an uncluttered front-end, accessible to new crypto traders and familiar to anyone who has traded on a Swap DEX or Centralised Exchange

Deep liquidity - As of January 2024, over 570 million USD in liquidity is available to traders on GMX. The GM pool for BTC on Arbitrum contains 135 million in liquidity just by itself. Moreover, all of this liquidity is user-contributed, and it has proven to be sticky.

The pillars of GMX are its strong community, its focus on transparency, and robust security. GMX did not launch with any seed funding or Venture Capital backing. It has been a community-driven protocol from the start, and is dedicated to security – with a public code repo, public metrics and bounties, and rolling audits. Due to its composable nature, it forms a foundational layer for decentralised finance on the two blockchains it is deployed on:

What is the unique advantage of building on Arbitrum? Why did you choose to build on Arbitrum?

Arbitrum, as an Ethereum Layer-2 solution, has an efficient code base and messaging layer that allows a computationally dense smart-contract protocol like GMX to execute with low gas fees. Something as simple as GMX’s rewards claim function would cost exponentially more to execute on Ethereum Mainnet. Additionally, price updates do not happen at speed on Mainnet, which is essential for successfully executing a strategy using perpetual futures contracts.

So, Arbitrum was one of the first blockchains to promise minimal time-to-finality, low gas costs, and swift execution. That makes for an attractive package, particularly coupled with the security of Ethereum. And without a mem-pool, toxic flow on Arbitrum is minimalised.

Alongside these tech stack advantages, there is an important social component: Offchain Labs and the Arbitrum Foundation have a similar long-term vision to GMX. A collaborative approach, which emphasises composability and working together; slowly, diligently fostering and building out an ecosystem.

How do Chainlink Data Streams fit into the picture for GMX and the launch of GMX V2?

The low-latency Chainlink Data Streams oracles provide faster execution and enable GMX to offer UI/UX optionality that wasn’t possible before. This is simply based on how on-chain price data worked with Chainlink Price Feeds, which were incredibly important for GMX V1 and the general design philosophy of the GMX protocol.

Prior to the integration of Data Streams, something like updating a position, or having reliable trigger orders, could not be offered without running into older problems that the protocol wanted to move away from. Think: relying on in-house keepers, or the fact that the pace at which price updates happened made it hard to fulfill orders at a speed fully responsive to market movements.

Because Data Streams’ next-gen low-latency oracle solution is more granular, and pull-based, users now enjoy an even more CEX-like trading experience, while knowing that GMX V2 is underpinned by Chainlink’s industry-standard security infrastructure. Plus, GMX no longer has to do any heavy lifting on the technical end to prevent frontrunning.

Why did you choose to build with Chainlink? What does Chainlink uniquely unlock?

Chainlink has a proven track record of delivering value for critical DeFi infrastructure. It is not enough to just be in the crypto space for a long time; Chainlink has earned the trust of the large majority of DeFi protocols and positioned itself as foundational Web3 infrastructure.

As GMX endeavours to be a DeFi staple, it was only natural that this aspiration be met through a collaboration with a pioneering team of builders as well-established as Chainlink.

What specific key results have already been achieved (user growth, new markets, liquidity, total value locked, engineering time saved, etc.)?

Integrating Chainlink Data streams has helped enable GMX to scale in both speed and security, without having to sacrifice decentralisation or build and maintain its own in-house infrastructure. GMX can now deliver a user experience that competes with centralised exchanges, while focusing its resources on growing its user base and core product offering.

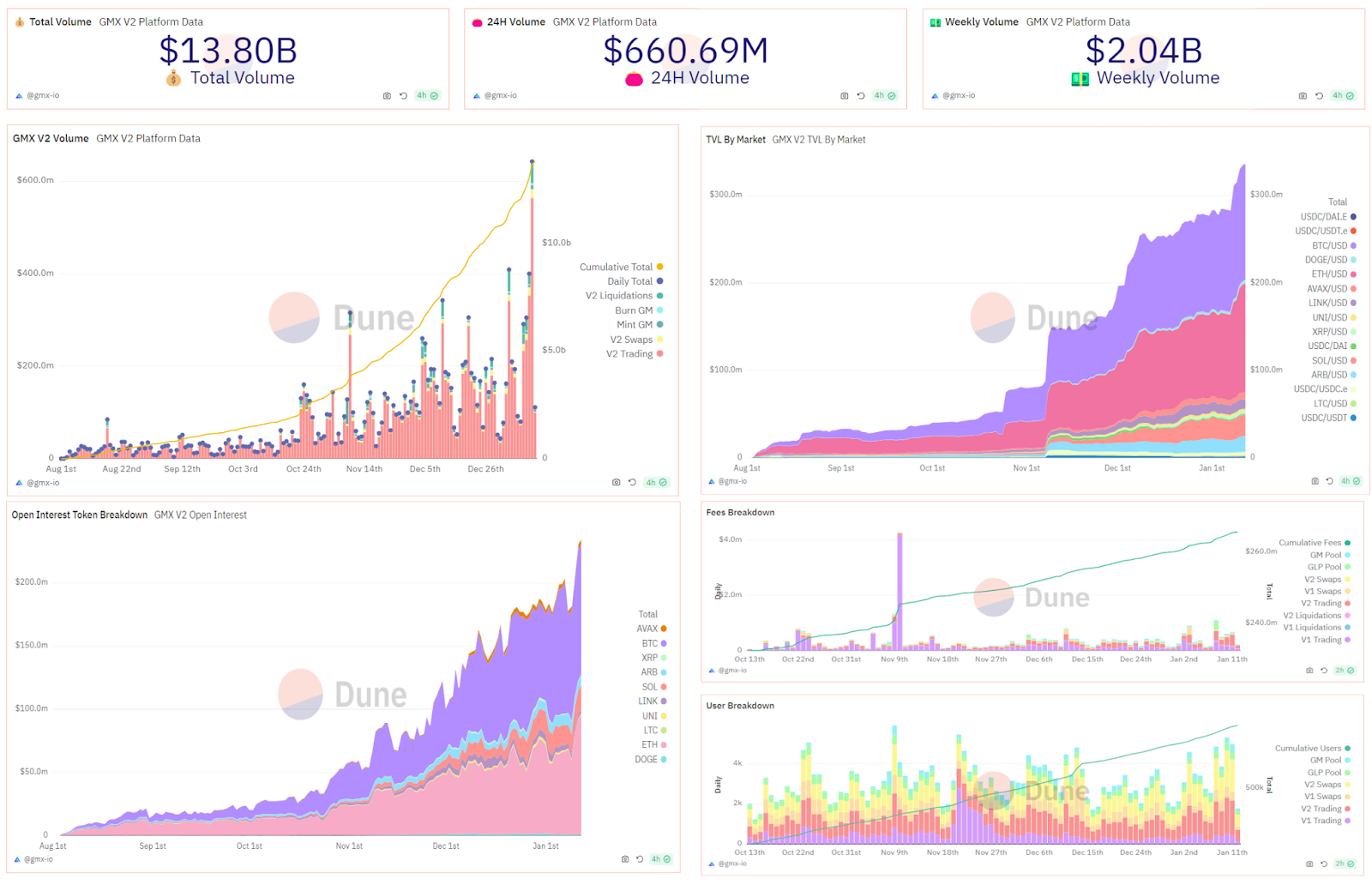

To date (January 2024), GMX V2 has achieved the following milestones:

$360 million TVL in Liquidity in the GM Pools

$300 million in Open interest as of 01/11/2024

$2 billion in weekly volume between Jan 5 and 11

$12.33 million in total fees generated

And 104,000 unique users, in addition to the already sizable V1 user base.

Additionally, GMX V2 now supports nine markets, compared to V1’s four.

What was the experience like working with Chainlink Labs & Offchain Labs?

It’s been inspiring. The experience with pricing data and its nuances, the ability to work closely alongside GMX’s development, and the innovative approach to collaboration were crucial for getting GMX V2 to production. Chainlink’s support is second to none and a prime example of the ecosystem philosophy GMX has adopted. The experience with Offchain Labs has been similar, with close contact from the start and valuable and in-depth exchange on vital technical topics.

The DeFi and Web3 space likes to pride itself on heads-down builders. But Chainlink Labs and Offchain Labs have shown that key players are not above taking the time to help others build robust products.

After all, sadly, the space is still regularly impacted by fundamental errors in code and design. This level of intense protocol-to-protocol collaboration enshrines good habits that will carry DeFi and Web3 adoption further into the future.

What are the long-term objectives for GMX? How does it fit into the future of Web3?

The long-term objective of GMX is to be a permissionless and foundational layer within DeFi. On two ends: accessible trading with transparent and verifiable funding sources; sustainable yield from a transparent and intuitive source (trading activity on GMX), coupled with a range of decentralised dApp front-ends hosted by external parties.

With the advent of DeFi copy-trading projects, on-chain managed funds, and Telegram trading bots, we hope that GMX, like Chainlink, becomes a part of Web3’s next iteration – where we imagine things like account abstraction through simplified social media platforms enable people to do something as complex as execute trade strategies from the comfort of a chatroom, or maybe a DAO.

More concretely, in the short term, GMX remains focused on adding new liquid markets, expanding its community and DeFi ecosystem, reaching new audiences, and further optimising the non-custodial on-chain trading experience.