GMX introduces GMX Liquidity Vaults (GLV), now live on Arbitrum & Avalanche

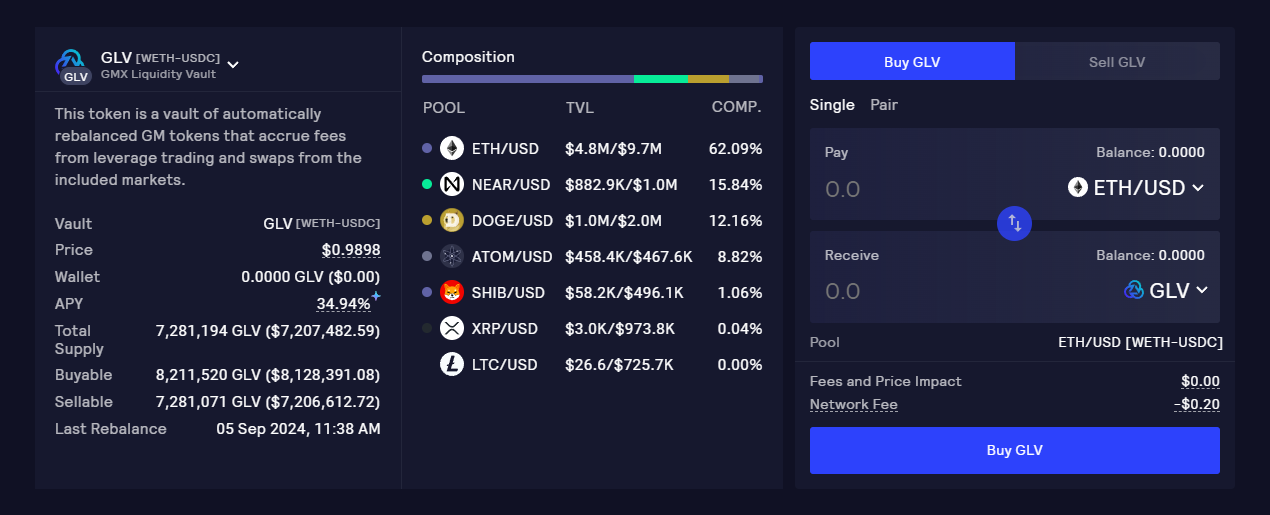

GMX has launched GLV, a vault of dynamically rebalancing GM liquidity tokens. GLV is a 'pool of pools', optimising liquidity between its underlying GM pools and generating fees from all those markets.

GLV dynamically allocates its liquidity to its underlying GM pools that share common collateral, based on their utilisation and demand. This mechanism ensures that liquidity in the vault flows to the GMX markets that need it the most, providing traders with the deep liquidity they desire and offering LPs higher capital efficiency.

GLV also provides all the builders in GMX’s extensive decentralised finance ecosystem with an additional high-quality, composable asset to leverage in their products and strategies.

First GLV Vault Composition

The first vault is GLV [WETH-USDC], now live on the Arbitrum blockchain. This vault consists of all GM Markets that use WETH/USDC as their underlying liquidity pool tokens, in the following composition.

ETH/USD - 65.88%

DOGE/USD - 12.35%

NEAR/USD - 11.71%

ATOM/USD - 8.95%

SHIB/USD - 1.07%

XRP/USD - 0.04%

LTC/USD - 0.00%

These allocation percentages will dynamically update, as the vault rebalances its liquidity between GM markets based on demand.

Other GLV Vaults

An additional GLV vault based on BTC/USDC has now been introduced, covering all the Bitcoin-related markets on GMX on Arbitrum that use BTC/USDC as collateral for their underlying GM pools.

On the Avalanche blockchain, a GLV product based on WAVAX/USDC has been launched. This vault offers dynamically optimised exposure to all the synthetic markets with WAVAX/USDC as their underlying pool tokens.

Bootstrap incentives for GLV on Avalanche are live, and can be seen at: https://app.gmx.io/#/pools/

Purchasing GLV

GLV can be purchased with its underlying tokens, as well as any of its GM pool tokens. Note that purchasing GLV with any of its underlying GM tokens costs no fees. GMX’s recently introduced SHIFT functionality for GM liquidity providers makes this zero-fee liquidity transfer possible.

Earning with GLV

GLV is the index pool of GM Markets, rebalancing liquidity to its best-performing GM pools and generating fees from them. As a result, GLV offers liquidity providers a balanced instrument with stable risk-adjusted returns and high capital efficiency.

Just as with the separate GM pools, holders of GLV:

are exposed to the price movements of the underlying assets.

are exposed to trader PnL, as long as the GM pools aren't 50/50 balanced between Longs/Shorts.

earn fees from the pools at the listed rate. These fees are auto-compounded, automatically increasing the price of your GLV tokens.

Providing Liquidity on GMX

GMX's vision is to offer the deepest liquid markets for all top crypto assets on-chain. Equitable, open markets that allow all liquidity providers to share in the fees from the liquid markets they support.

With the introduction of GLV, liquidity on GMX V2 can now be provided through both the automatically rebalancing GLV Pool and individual GM Pools. Liquidity providers earn fees from leverage trading, borrowing fees, and swaps, regardless of which of the two options they prefer.

Read more about how to earn fees from providing liquidity on GMX V2: https://docs.gmx.io/docs/providing-liquidity/v2

Join the GMX community:

Website: https://gmx.io/

Twitter: https://twitter.com/GMX_IO

Telegram: https://t.me/GMX_IO

Announcements: https://t.me/GMX_Announcements

Discord: https://discord.gg/H5PeQru3Aa

Github: https://github.com/gmx-io

Documentation: https://docs.gmx.io/

Disclaimer

This announcement is for informational purposes only and does not constitute legal, financial, or investment advice. GMX or any other parties make no warranties or representations regarding the accuracy, completeness, or suitability of the information presented and will not be liable for any losses, damages, or adverse consequences that may arise in relation to this announcement.

It is strongly advised to undertake your own due diligence and seek advice from relevant professionals before making decisions based on this announcement.

Thanks devs.