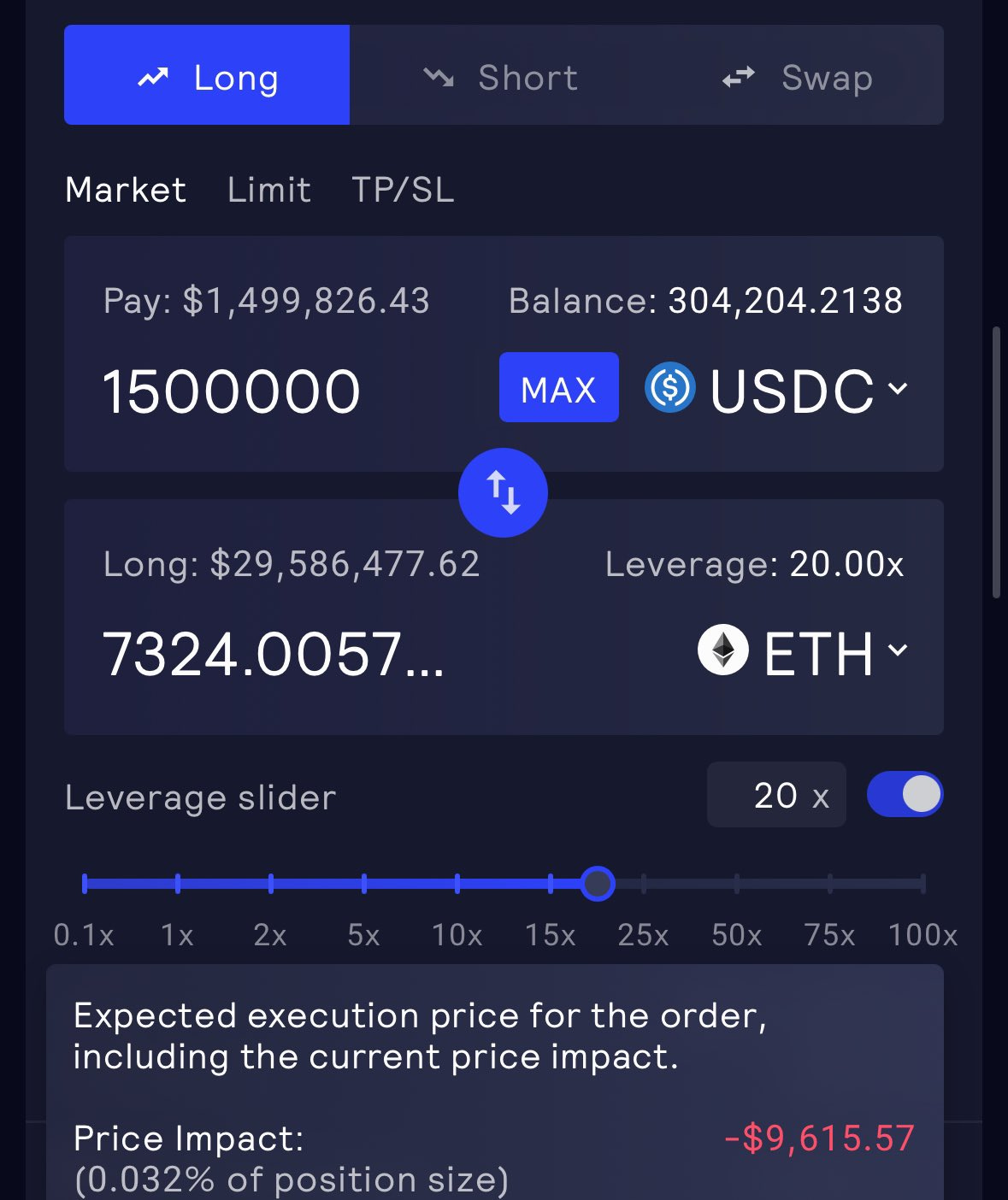

Price Impact on GMX now much lower, due to dynamic Edge Risk Oracles from Chaos Labs

Integrating the sophisticated risk oracle mechanism has decreased the price impact across most GMX markets to a level rivalling even the biggest centralised exchanges.

GMX has successfully integrated Edge Risk Oracles from Chaos Labs to dynamically manage price impact in its Arbitrum markets. This advancement in on-chain risk management enables real-time, contextual adjustments to market parameters. As a result, price impact has been significantly reduced on nearly all markets, and traders now enjoy more competitive pricing.

Try it now and feel the difference: app.gmx.io

Exec Summary

Dynamic Price Impact updates enabled on Arbitrum by cutting-edge Edge Risk Oracles

The new mechanism decreases price impact across most GMX markets to industry-leading levels

Overall trading experience on GMX further streamlined thanks to this innovation

Why GMX integrated Edge Risk Oracles

In the past, market parameters on GMX were updated manually, after periodic reviews or in response to significant events affecting the liquidity pools. While this manual process worked, it also introduced delays. This delay necessitates conservative parameters and higher fees to address potential market fluctuations.

With the integration of Chaos Labs' Risk Oracle, GMX now automates these updates, enabling the protocol to adjust critical parameters like price impact instantly in real-time.

This automation offers several key advantages to GMX:

Much more competitive execution costs and pricing

Boosted protection against price manipulation and extreme volatility.

Reduced manual workload for developers

GMX becomes even more antifragile and decentralised.

“Overall, the integration of Edge Risk Oracles ensures more precise and responsive risk management, while significantly boosting the user experience for traders.”

How Edge Risk Oracles work

Risk Oracles provide a real-time solution through a continuous data stream, allowing GMX to respond dynamically to changing market conditions without having to set overly conservative parameters.

The innovative system constantly recalibrates based on data from both CEXs and DEXs, adapting to current conditions. By automatically monitoring key factors like liquidity, volatility, and trading activity, the system can adjust parameters almost instantaneously.

This real-time mechanism ensures the protocol remains resilient against any sudden market changes. It also enables the instant easing of risk parameters as liquidity conditions improve, promoting greater capital efficiency.

Open Interest maximums for the GMX V2 markets were already being effectively managed by the Edge Risk Oracles. The dynamic adjustment of Price Impact settings is now being handled by the Risk Oracles as well, resulting in much lower overall price impact.

What’s Next for GMX & Chaos Labs

The integration of Edge Risk Oracles into GMX follows a 3-step implementation plan:

Phase 1: Support for maximum open interest updates (completed)

Phase 2: Support for dynamic price impact updates (completed)

Phase 3: Expanding support to parameters like swap price impact, max pool size, funding rate, and borrowing rate.

We look forward to seeing the additional improvements that can be realised in Phase 3 of the integration.

About the Chaos Labs & GMX partnership

Chaos Labs is the selected Risk Manager for the GMX DAO, supporting protocol health monitoring as well as providing essential market parameters for GMX V2.

Learn more about how Chaos Labs approaches risk monitoring for the GMX DAO.

Join the GMX community:

Website: https://gmx.io/

Twitter: https://twitter.com/GMX_IO

Telegram: https://t.me/GMX_IO

Announcements: https://t.me/GMX_Announcements

Discord: https://discord.gg/H5PeQru3Aa

Github: https://github.com/gmx-io

Documentation: https://docs.gmx.io/